(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

| Fee paid previously with preliminary materials. | |||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

102 South Clinton St.

Iowa City, Iowa 52240

(319) 356-5800

March 9, 201816, 2021

Dear Shareholder:

On behalf of the board of directors and management of MidWestOneMidWestOne Financial Group, Inc. (the “Company”), we cordially invite you to attend the annual meetingAnnual Meeting of shareholdersthe Shareholders (the “Annual Meeting”) of MidWestOne Financial Group, Inc.the Company to be held at 2:00 p.m. central time on Thursday, April 19, 2018,29, 2021, at the Hotel Vetro,Company’s headquarters, located at 201102 S. Linn Street,Clinton St., Iowa City, Iowa 52240.52240, and by means of remote communication through an online virtual meeting at www.virtualshareholdermeeting.com/MOFG2021. We strongly encourage all shareholders to attend the Annual Meeting through the online virtual meeting webcast rather than in person. When you access the live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/MOFG2021, you will be able to vote your shares electronically and submit your questions during the meeting. You will need to have your 16-digit control number included on your notice (or proxy card if you received paper copies of the proxy materials) to join, ask questions at and vote at the Annual Meeting online via live webcast.

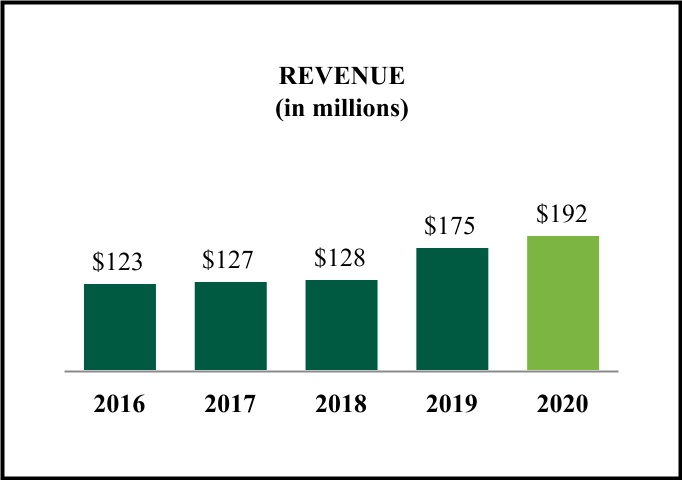

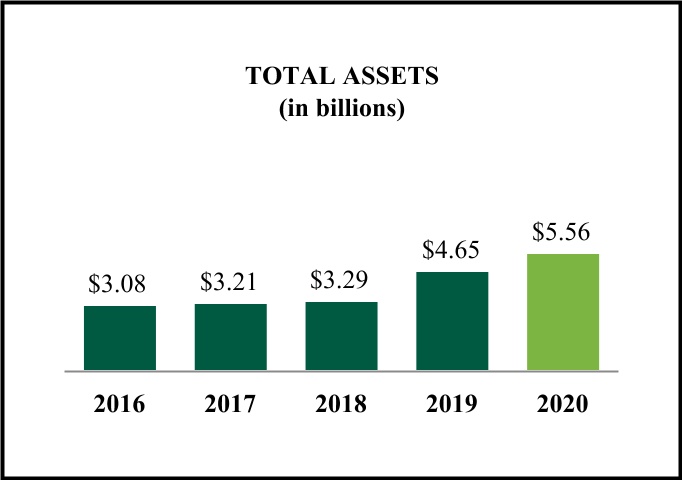

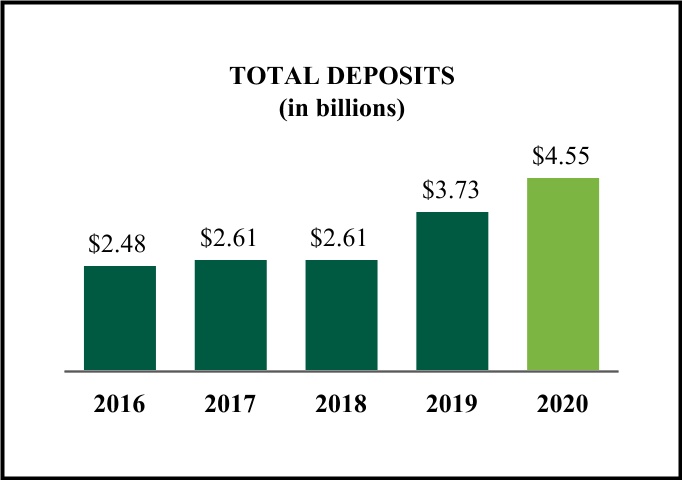

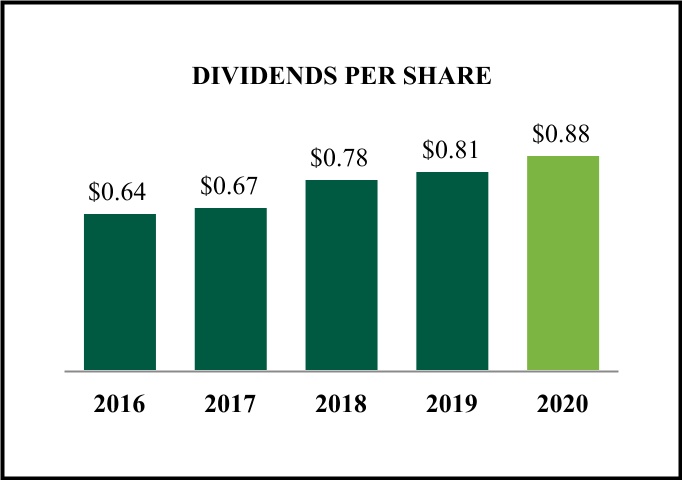

Our Nominating and Corporate Governance Committee has nominated fourfive persons to serve as directors, all of whom are incumbent directors, except for Nathaniel J. Kaeding.directors. We have also included a non-binding advisory proposal to approve the compensation of our named executive officers, or "say-on-pay" proposal, as well as a non-binding advisory proposal regarding the frequency with which shareholders will vote on such say-on-pay proposals in the future.proposal. Finally, our Audit Committee has selected, and we recommend that you ratify the selection of, RSM US LLP to act as ourthe Company’s independent registered public accounting firm for the year ending December 31, 2018.2021. We recommend that you vote your shares for each of the fourfive director nominees, in favor of the compensation arrangements of our named executive officers, for future say-on-pay votes to take place every year, and in favor of the ratification of our independent registered public accounting firm. AtDuring the meeting,Annual Meeting, we will also review our performance in 20172020 and update you on how we are dealing with the current economic environment and our strategic plan as we move forward.

Very truly yours,

Kevin W. Monson

Chair of the meeting.Board

| ||

102 South Clinton St.

Iowa City, Iowa 52240

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 19, 201829, 2021

To Our Shareholders:

The Annual Meeting of the Shareholders (the “Annual Meeting”) of MidWestOne Financial Group, Inc. (the “Company”) is being held at 2:00 p.m. central time on Thursday, April 19, 2018,29, 2021, at the Hotel Vetro,Company’s headquarters, located at 201102 S. Linn Street,Clinton St., Iowa City, Iowa 52240, and by means of remote communication through an online virtual meeting at www.virtualshareholdermeeting.com/MOFG2021, for the following purposes:

1.to elect five individuals to serve as Class II members of the board of directors for terms expiring at the 2024 annual meeting of shareholders and until their successors are elected and have been qualified;

2.to approve, on a non-binding, advisory basis, the compensation of our named executive officers, as described in the accompanying proxy statement, which is referred to as a “say-on-pay” proposal;

3.to ratify the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021; and

4.to transact such other business as may properly be brought before the meeting and any adjournments or postponements of the meeting.

We strongly encourage all shareholders to attend the Annual Meeting through the online virtual meeting webcast rather than in person. When you access the live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/MOFG2021, you will be able to vote your shares electronically and submit your questions during the meeting. You will need to have your 16-digit control number included on your notice (or proxy card if you received paper copies of the proxy materials) to join, ask questions at and vote at the Annual Meeting online via live webcast.

Only shareholders of record on our books at the close of business on March 1, 2018,4, 2021, the record date for the annual meeting,Annual Meeting, are entitled to notice of, and to vote at, the annual meetingAnnual Meeting and any adjournments or postponements of the annual meeting.Annual Meeting. In the event there are an insufficient number of votes for a quorum or to approve or ratify any of the foregoing proposals at the time of the annual meeting,Annual Meeting, the meeting may be adjourned or postponed in order to permit us to further solicit proxies. We look forward to seeing you online at the meeting.

By Order of the Board of Directors

| ||

Kevin W. Monson

Chair of the Board

Iowa City, Iowa

March 9, 201816, 2021

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, IN PERSON, PLEASE TAKE THE TIMEWE URGE YOU TO VOTE AND SUBMIT YOUR PROXY IN ADVANCE OF THE MEETING BY FOLLOWING THE INSTRUCTIONS PROVIDED ON THE NOTICE. WE HOPE THAT YOU WILL BE ABLE TO ATTEND THE MEETING THROUGH THE ONLINE VIRTUAL MEETING WEBCAST, AND, IF YOU DO, YOU MAY VOTE YOUR SHARES IN PERSON IF YOU WISH.AT THAT TIME. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO ITS EXERCISE.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on April 29, 2021:

Our proxy statement and 2020 Annual Report on Form 10‑K are available online at www.midwestonefinancial.com.

| Table | ||||||||

| Page | ||||||||

MIDWESTONE FINANCIAL GROUP, INC.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

April 29, 2021

This proxy statement is being furnished to our shareholders in connection with the solicitation by our board of directors of proxies to be used at the annual meetingAnnual Meeting of shareholdersthe Shareholders (the “Annual Meeting”) to be held at 2:00 p.m. central time on Thursday, April 19, 2018,29, 2021, at the Hotel Vetro,Company’s headquarters, located at 201102 S. Linn Street,Clinton St., Iowa City, Iowa 52240, and by means of remote communication through an online virtual meeting at www.virtualshareholdermeeting.com/MOFG2021, or at any adjournments or postponements of the meeting. We strongly encourage all shareholders to attend the Annual Meeting through the online virtual meeting webcast rather than in person. When you access the live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/MOFG2021, you will be able to vote your shares electronically and submit your questions during the meeting. You will need to have your 16-digit control number included on your notice (or proxy card if you received paper copies of the proxy materials) to join, ask questions at and vote at the Annual Meeting online via live webcast. This proxy statement, together withand a copy of our Annual Report on Form 10-K for the year ended December 31, 2017,2020, which we have filed with the Securities and Exchange Commission (the “SEC”), is first being transmitted or deliveredmade available to our shareholders on or about March 9, 2018.16, 2021 and March 11, 2021, respectively.

QUESTIONS AND ANSWERS

The following is information regarding the meeting and the voting process, presented in a question and answer format. As used in this proxy statement, the terms “MidWestOneFinancial Group,” “MidWestOne Financial,” “the Company,the “Company,” “we,” “our,” and “us” all refer to MidWestOne Financial Group, Inc. and its consolidated subsidiaries. The terms “MidWestOne Bank” and “the Bank”the “Bank” refer to the Company’s wholly-owned banking subsidiary, MidWestOne Bank, Iowa City, Iowa.

Q: What is a proxy statement? A.A proxy statement is a document, such as this one, required by the SEC that, among other things, explains the items on which you are asked to vote on at the Annual Meeting. Q: Why did I receive access to the proxy materials? A.We have made the proxy materials available to you over the Internet because on March 4, 2021, the record date for the Annual Meeting, you owned shares of MidWestOne Financial common stock. This proxy statement lists the matters that will be presented for consideration by our shareholders at the Annual Meeting to be held on April 29, 2021. It also gives you information concerning the matters to assist you in making an informed decision. |

If you vote pursuant to the instructions set forth in the notice and herein, you appoint the proxy holders as your representatives at the meeting. The proxy holders will vote your shares as you have instructed, thereby ensuring that your shares will be voted whether or not you attend the meeting. Even if you plan to attend the meeting, we ask that you instruct the proxies how to vote your shares in advance of the meeting just in case your plans change and you are unable to attend in person.person or through the online virtual meeting webcast.

If you have voted over the Internet or by telephone or signed and returned the proxy card and an issue comes up for a vote atduring the meetingAnnual Meeting that is not identified in the proxy materials, the proxy holders will vote your shares, pursuant to your proxy, in accordance with their judgment.

Q: Why did I receive a notice regarding the Internet availability of proxy materials instead of paper copies of the proxy materials?

A.We are using the SEC’s notice and access rule that allows us to furnish our proxy materials over the Internet to our shareholders instead of mailing paper copies of those materials to each shareholder. As a result, beginning on or about March 9, 2018,16, 2021, we sent our shareholders by mail a notice containing instructions on how to access our proxy

1

materials over the Internet and vote. This notice is not a proxy card and cannot be used to vote your shares. If you received a notice this year, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the notice.

Q:What matters will be voted on at the meeting?

| A.You are being asked to vote on: (i) |

Q: Why is the Company holding a hybrid virtual and in-person Annual Meeting? A.Due to the ongoing public health impact of the coronavirus pandemic (COVID-19) and to support the health and well-being of our employees and shareholders, our board of directors determined that it would be in the best interests of our shareholders for the Company to hold a hybrid virtual and in-person Annual Meeting. We believe that hosting a hybrid virtual and in-person Annual Meeting will enable more of our shareholders to attend the meeting because it will limit contact with other individuals in light of COVID-19 concerns and it will allow our shareholders to participate from any location around the world with Internet access. Q: How can I attend the Annual Meeting? A.The Annual Meeting will be held both through an online virtual meeting webcast at www.virtualshareholdermeeting.com/MOFG2021, and in person at the Company’s headquarters, located at 102 S. Clinton St., Iowa City, Iowa 52240. We strongly encourage all shareholders to attend the meeting virtually rather than in person. Online access to the webcast will open approximately 15 minutes prior to the start of the Annual Meeting, which will begin promptly at 2:00 p.m. central time on April 29, 2021, to allow time for you to log in and test the computer software. We encourage our shareholders to access the meeting prior to the start time to allow ample time to complete the online check-in process. You will need to have your 16‐digit control number included on your notice (or proxy card if you received paper copies of the proxy materials) to join, ask questions at and vote at the Annual Meeting via the online virtual meeting webcast. You will be able to vote your shares electronically and submit your questions during the meeting online. The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the meeting. Participants should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the meeting. A technical support number will be made available on the virtual meeting webpage during check-in for shareholders who experience technical difficulties accessing the virtual Annual Meeting. A complete list of the shareholders entitled to vote at the Annual Meeting will be made available for inspection by clicking the designated shareholder list link that will appear on your screen. The shareholder list may be accessed at any time during the meeting or any adjournment. You are entitled to participate in the Annual Meeting only if you were a shareholder of record as of the record date or if you hold a valid proxy for the Annual Meeting. If you are not a shareholder of record but hold shares as a beneficial owner in street name, you should follow the instructions for attending the Annual Meeting provided by your broker or other fiduciary. If you do not comply with the procedures outlined above, you will not be admitted to the Annual Meeting. Q: How do I ask questions at the Annual Meeting if I attend the online virtual meeting webcast? A.To ask a question through the online virtual meeting webcast at www.virtualshareholdermeeting.com/MOFG2021, you will need to have your 16‐digit control number included on your notice (or proxy card if you received paper copies of the proxy materials). If you would like to submit a question, click on the “Q&A” button at the bottom of the screen, enter your question in the text box and click on “Submit” at any time during the Annual Meeting. 2 Q:How do I vote? A.After reviewing this document, submit your proxy using any of the proxy voting methods indicated on the notice. You may vote by telephone (if you received paper copies of the proxy materials), by Internet, by mail by completing, signing, dating and mailing the proxy card you received in the mail (if you received paper copies of the proxy materials), live in person at the meeting, or through the online virtual meeting webcast. By submitting your proxy, you authorize the individuals named in it to represent you and vote your shares at the Annual Meeting in accordance with your instructions. Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote by following the instructions on the notice. |

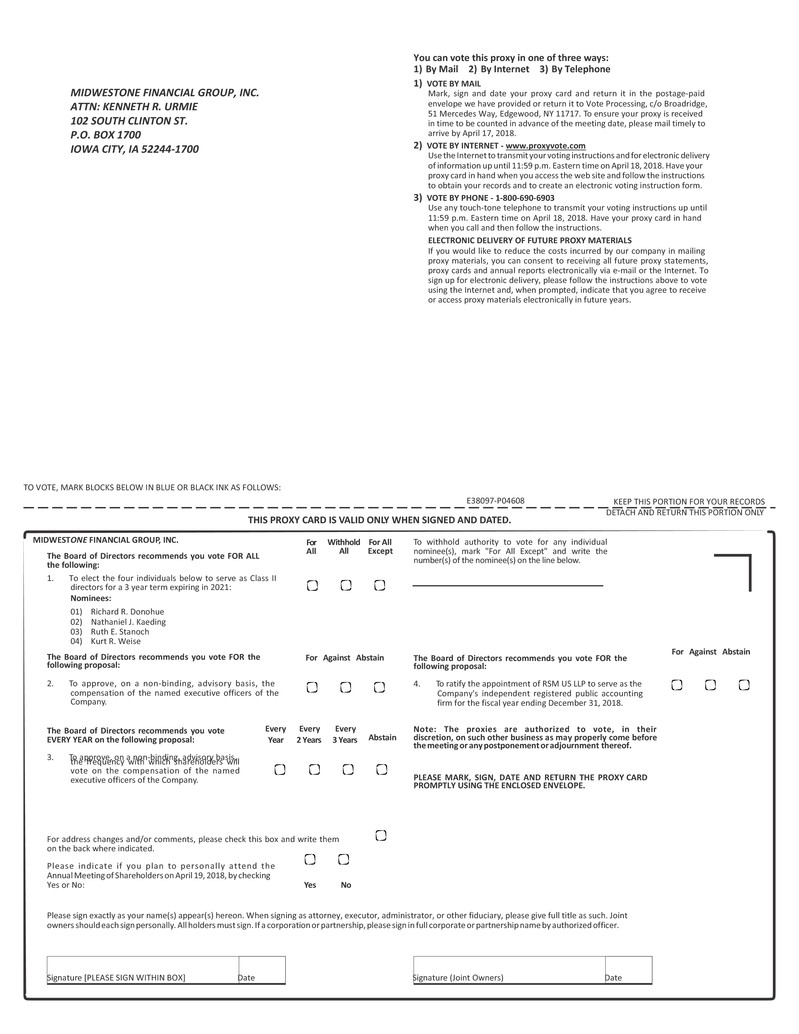

If you sign, date, and return your proxy card but do not mark the card to provide voting instructions, the shares represented by your proxy card will be voted “for” all fourfive nominees named in this proxy statement, “for” the say-on-pay proposal, for future say-on-pay proposals to be voted on “every year,” and “for” the ratification of the appointment of RSM US LLP as ourthe Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018.2021.

If you are a beneficial owner and a broker or other fiduciary is the record holder (which is usually referred to as “street name” ownership), then you received access to these proxy materials from the record holder of the shares that you beneficially own. The record holder should have given you instructions for directing how the record holder should vote your shares. It will then be the record holder’s responsibility to vote your shares for you in the manner you direct.

To vote during the Annual Meeting, you may go to www.virtualshareholdermeeting.com/MOFG2021 to attend the Annual Meeting via online virtual meeting webcast and vote online. You will need to have your 16-digit control number included on your notice (or proxy card if you received paper copies of the proxy materials) when you access the website and follow the instructions to vote by clicking the “voting” button on your screen. Shares held in your name as the shareholder of record may be voted electronically during the Annual Meeting. Shares held in the name of a broker or other fiduciary also may be voted electronically during the Annual Meeting by following the instructions provided by your broker or other fiduciary. If you want to voteattend the Annual Meeting in person, please come to the meeting. Wewe will distribute written ballots to anyone who wants to vote at the meeting. Please note, however, that if your shares are held in the name of a broker or other fiduciary (i.e., in street name), you will need to arrange to obtain a legal proxy from the record holder in order to vote in person at the meeting. Even if you plan to attend the annualAnnual Meeting through the online virtual meeting webcast or in person, we ask that you complete and return your proxy card, or vote by telephone or Internet, in advance of the annual meetingAnnual Meeting in case your plans change.

Q:If I hold shares in the name of a broker, who votes my shares?

A.Under the rules of various national and regional securities exchanges, brokers and other fiduciaries that hold securities on behalf of beneficial owners generally may vote on routine matters even if they have not received voting instructions from the beneficial owners for whom they hold securities, but are not permitted to vote on non-routine matters unless they have received such voting instructions. The ratification of the appointment of the Company’s independent registered public accounting firm is considered to be a routine matter, and the election of directors and say-on-pay proposal are considered to be non-routine matters. Thus, if you do not provide instructions to your broker as to how it should vote the shares beneficially owned by you, your broker will be able to vote on the ratification of the appointment of RSM US LLP as our independent registered public accounting firm, but generally will not be permitted to vote on any of the other matters described in this proxy statement.

We therefore encourage you to provide directions to your broker as to how you want your shares voted on all matters to be brought before the meeting. You should do this by carefully following the instructions your broker gives you concerning its procedures.

Q: How will my shares of common stock held in the employee stock ownership plan be voted? A.We maintain an employee stock ownership plan ("ESOP") that owns 346,412, or 2.2%, of the current outstanding shares of our common stock. Employees of the Company and the Bank participate in the ESOP. As of the record date, 346,412 shares have been allocated to ESOP participants. Each ESOP participant has the right to instruct the trustee of the plan how to vote the shares of our common stock allocated to his or her account under the ESOP. If an ESOP participant properly executes the voting instruction card, the ESOP trustee will vote the participant's shares in accordance with the participant's instructions. Shares of our common stock held in the ESOP, but not allocated to any participant's account, |

and allocated shares for which no voting instructions are received from participants, will be voted by the trustee in proportion to the results of the votes cast on the issue by the participants and beneficiaries.

3

Q:What does it mean if I receive more than one notice card?

A.It means that you have multiple holdings reflected in our stock transfer records and/or in accounts with stockbrokers. To vote all of your shares by proxy, please follow the separate voting instructions that you received for the shares of common stock held in each of your different accounts.

Q:What if I change my mind after I vote?

A.If you hold your shares in your own name, you may revoke your proxy and change your vote at any time before the polls close at the meeting. You may do this by:

•timely submitting another proxy via the telephone or Internet, if that is the method that you originally used to submit your proxy;

•signing another proxy card with a later date and returning that proxy card to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717, by mail;

•sending notice to us that you are revoking your proxy; or

•voting in person at the meeting.meeting or through the virtual online meeting webcast.

All written notices of revocation and other written communications with respect to revocation of proxies should be sent to: MidWestOne Financial Group, Inc., 102 South Clinton St., Iowa City, Iowa 52240, Attention: Corporate Secretary. If you hold your shares in the name of your broker or other fiduciary and desire to revoke your proxy, you will need to contact that party to revoke your proxy.

Q:How many votes do we need to hold the annual meeting?

A.The holders of a majority of the votes entitled to be cast as of the record date must be present in person or by proxy at the Annual Meeting in order to hold the meeting and conduct business. Votes are counted as present at the meeting if the shareholder either:

•is present and votes in person at the meeting;meeting or through the virtual online meeting webcast; or

•has properly submitted a signed proxy card or other form of proxy (through the telephone or Internet).

Virtual attendance at the Annual Meeting constitutes “in person” for purposes of determining a quorum at the Annual Meeting. On March 1, 2018,4, 2021, the record date, there were 12,235,24015,981,088 shares of common stock issued and outstanding. Therefore, at least 6,117,6217,990,545 shares need to be present, in person at the meeting, through the virtual online meeting webcast, or by proxy, at the annualAnnual Meeting to hold the meeting and conduct business.

Q:What happens if a nominee is unable to stand for re-election?

A.The board may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxies may be voted for a substitute nominee. Proxies cannot be voted for more than five nominees. We have no reason to believe any nominee will be unable to stand for re-election.

Q:What options do I have in voting on each of the proposals?

A.Except with respect to the election of directors, you may vote “for,” “against” or “abstain” on each proposal properly brought before the meeting. In the election of directors, you may vote “for” or “withhold authority to vote for” each nominee. There is no cumulative voting for the election of directors.

Q:How many votes may I cast?

A.Generally, you are entitled to cast one vote for each share of stock you owned on the record date.

4

Q:How many votes are needed for each proposal?

A.Except with respect to the election of directors, each matter that arises at the Annual Meeting will be approved if the votes cast favoring the action exceed the votes cast opposing the action. Directors will be elected by a plurality of the votes cast, and the five individuals receiving the highest number of votes cast “for” their election will be elected as directors of MidWestOne. Please note, however, that because the say-on-pay vote is advisory, the outcome of such vote will not be binding on the board of directors or the Compensation Committee.

Also, please remember that the election of directors and the say-on-pay proposal and the frequency of future say-on-pay votes are allboth considered to be non-routine matters. As a result, if your shares are held by a broker or other fiduciary, it cannot vote your shares on these matters unless it has received voting instructions from you.

Abstentions and broker non-votes, if any, will not be counted as votes cast, but will count for purposes of determining whether or not a quorum is present. Accordingly, so long as a quorum is present, abstentions and broker non-votes will have no effect on any of the matters presented for a vote at the annual meeting.Annual Meeting.

Q:Where do I find the voting results of the meeting?

A.If available, we will announce voting results during the Annual Meeting. The voting results also will be disclosed in a Form 8-K that we expect to file within four business days after the Annual Meeting.

Q:Who bears the cost of soliciting proxies?

A.We will bear the cost of soliciting proxies. In addition to solicitations by mail, our officers, directors or employees may solicit proxies in person, by telephone, or by email. These persons will not receive any special or additional compensation for soliciting proxies. We may reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to shareholders.

YOUR VOTE IS IMPORTANT. PLEASE VOTE BY INTERNET OR TELEPHONE OR RETURN YOUR MARKED AND SIGNED PROXY CARD PROMPTLY SO YOUR SHARES CAN BE REPRESENTED, EVEN IF YOU PLAN TO ATTEND THE MEETING IN PERSON.PERSON OR THROUGH THE ONLINE VIRTUAL MEETING WEBCAST.

5

PROPOSAL 1:

ELECTION OF DIRECTORS

MidWestOne Financial’s board of directors is divided into three classes. At the annual meetingAnnual Meeting to be held on April 19, 2018,29, 2021, you will be entitled to elect fourfive directors for terms expiring in 2021,at the 2024 Annual Meeting and until their successors are elected and have been qualified, as described herein. We have no knowledge that any of the nominees will refuse or be unable to serve as directors, but if any of the nominees becomes unavailable for election, the holders of proxies reserve the right to substitute another person of their choice as a nominee when voting at the meeting.

The Nominating and Corporate Governance Committee of our board of directors has nominated fourfive persons for election at this annual meeting,Annual Meeting, all of whom are incumbent directors, except for Nathaniel J. Kaeding.directors. These nominations were further approved by the full board. We did not receive any shareholder nominations for directors for the 20182021 annual meeting. Set forth below is information concerning the nominees for election and for the other directors whose terms of office will continue after the meeting, including their age, year first elected or appointed as a director, position with MidWestOne Financial, qualifications to serve on the board and business experience. Unless otherwise specified, each position currently held by a nominee or director has been held for at least five years. The fourfive nominees for director, if elected at the annual meeting,Annual Meeting, will serve for terms expiring in 2021.at the 2024 annual meeting of shareholders and until their successors are elected and have been qualified.

Unless authority to vote for the nominees is withheld, the shares represented by the proxies will be voted “for” the election of the nominees proposed by the board of directors.

The board of directors recommends that you vote your shares “for” each of the nominees for director. Proxies properly submitted will be voted “for” each nominee unless shareholders specify otherwise.

INFORMATION ABOUT NOMINEES, CONTINUING DIRECTORS

AND NAMED EXECUTIVE OFFICERS

All directors will hold office for the terms indicated, or until their earlier death, resignation, removal or disqualification, and until their respective successors are duly elected and qualified. There are no arrangements or understandings between any of the nominees, directors or executive officers and any other person pursuant to which any of our nominees, directors or executive officers have been selected for their respective positions, except as described under “EXECUTIVE COMPENSATION-Potential Payments Upon Termination or Changebelow. Messrs. Albert and Weise and Mmes. Hauschildt and Stanoch were appointed to the board as required by certain provisions in Control-Employment Agreements - Messrs. Funk, Cantrell, Kramer,the Company’s former bylaws that were negotiated in connection with the Company’s acquisition of Central Bancshares, Inc. (“Central”), which occurred on May 1, 2015.

In accordance with the Agreement and Jehle” Plan of Merger between the Company and ATBancorp, which merger closed on May 1, 2019, the Company appointed two individuals designated by ATBancorp to the Company’s board of directors, subject to the board’s policies. ATBancorp identified Douglas H. Greeff and Richard J. Hartig to fill these positions, and they were appointed as Class I and Class II directors, respectively.

6

NOMINEES

| Class II - Term Expiring 2024 | |||||||||||||||||

| Director | |||||||||||||||||

| Name of Individual | Since | Position with MidWestOne Financial | |||||||||||||||

| Richard R. Donohue | 2008(1) | Director of MidWestOne Financial and the Bank | |||||||||||||||

2019(2) | |||||||||||||||||

Director of MidWestOne Financial and the Bank | |||||||||||||||||

Director of MidWestOne Financial and the Bank | |||||||||||||||||

| Ruth E. Stanoch | 2015 | Director of MidWestOne Financial and the Bank | |||||||||||||||

| Kurt R. Weise | 2015(3) | Director of MidWestOne Financial and the Bank | |||||||||||||||

| (1) | Mr. Donohue became a director of the Company upon completion of the merger with the former MidWestOne Financial Group, Inc. on March 14, 2008. He had been a director of the former MidWestOne Financial since 1999. | ||||||||||||||||

| (2) | Mr. Hartig became a director of the Company upon completion of the merger with ATBancorp on May 1, 2019. He had been a director of ATBancorp since 1991. | ||||||||||||||||

| (3) | Mr. Weise became a director of the Company upon completion of the merger with Central | ||||||||||||||||

Richard R. Donohue.Donohue. Mr. Donohue, 68,71, is the former Managing Partner of TD&T CPAs and Advisors, P.C. in Cedar Rapids, Iowa, a certified public accounting firm in which he was involved in all phases of the practice. Mr. Donohue joined the board of directors of the former MidWestOne Financial in 1999. He became a director of the Company upon completion of our merger with the former MidWestOne Financial in March 2008. Mr. Donohue was appointed to the board of directors of the Bank in 2009. We consider Mr. Donohue to be a qualified candidate for service on the board, the Audit Committee, and the Nominating and Corporate Governance Committee due to his business and financial accounting expertise acquired as the managing partner of a certified public accounting firm, as well as his knowledge of and prominence in our market area.

Richard J. Hartig. Mr. Hartig, 71, is Chairman of Hartig Drug Stores, a regional pharmacy chain, and founder of MedOne Healthcare Systems, a pharmacy benefits firm, both located in Dubuque, Iowa. He became a director of the Company and the Bank upon completion of our merger with ATBancorp in May 2019.He also served as a director of American Trust and Savings Bank since 1991. Mr. Hartig received his Bachelor’s degree in Pharmacy and an MBA, both from Drake University, and is a member of the Iowa Pharmacists Association. We consider Mr. Hartig to be a qualified candidate for service on the board and the Nominating and Corporate Governance Committee due to his experience as an entrepreneur and business owner with a lifelong Midwest presence.

Nathaniel J. Kaeding. Mr. Kaeding, 35,38, is the Director of Business Development and Client Relations for Build to Suit, Inc., a construction management and real estate development firm based in Bettendorf and Coralville, Iowa. Prior to his role with Build to Suit, Inc., Mr. Kaeding served as the Director of Retail Development for the Iowa City Downtown District where he managed economic development and various marketing, branding and place-making initiatives for the District. Mr. Kaeding is an Iowa City native and attended the University of Iowa as an undergraduate where he earned both academic and athletic All-American honors as a member of the University of Iowa football team. Mr. Kaeding was selected as the 65th pick in the 2004 NFL draft by the San Diego Chargers and enjoyed a nine-year career as a place-kicker in the NFL. Upon retirement from the NFL, Mr. Kaeding returned to Iowa City and earned an MBA from the University of Iowa. We consider Mr. Kaeding to be a qualified candidate for service on the board and the Nominating and Corporate Governance Committee due to his experience in the real estate industry and his strong ties within the Iowa City community, and his significant involvement in the Iowa City community.

Ruth E. Stanoch. Ms. Stanoch, 59,62, has been a corporate affairs consultant since 2008. She became a director of the Company upon completion of our merger with Central in May 2015 and a director of the Bank in 2016. Among her prior experiences, in 2010, Ms. Stanoch served as the senior advisor to Minnesota's governor-elect, Mark Dayton, and from 1994 to 2007, was employed with Thomson Legal & Regulatory. Between 2010 and 2012, Ms. Stanoch also served on various committees of the Board of Directors of Archipelago Learning, Inc., a leading subscription-based online education company, which was a public company. She received her Bachelor's degree from the University of Minnesota, and was a policy fellow at the University of Minnesota's Humphrey Institute of Public Affairs. Among other attributes, skills and qualifications, we believe that Ms. Stanoch's extensive corporate experience, leadership at a large corporation and previous service on a public company board provide valuable experience to the Company's board, Compensation Committee, and Nominating and Corporate Governance Committee.

7

Kurt R. Weise. Mr. Weise, 61,64, is the retired Executive Vice President of the Company, a position he held from May 2015 upon completion of our merger with Central until December 2016. Mr. Weise joined the board of directors of Central in 1988, and he became a director of the Company and the Bank upon completion of our merger with Central in May 2015. Mr. Weise also served as the Chairman of the Board of Central Bank from 1994 until 2015 and as the President of Central from 1988 until 2015. In addition, Mr. Weise has served in various finance and banking roles with Mr. Morrison and certain of his associates since 1985. Mr. Weise received his Bachelor’s degree from Winona State University, and he is a Certified Public Accountant. Among other attributes, skills and qualifications, we believe that Mr. Weise’s leadership as President of Central, his years of experience in finance and banking, and his status as a CPA enable him to bring valuable insight and knowledge to the Company’s board.

CONTINUING DIRECTORS AND NAMED EXECUTIVE OFFICERS

| Class I - Term Expiring 2023 | |||||||||||||||||

| Director | |||||||||||||||||

| Name of Individual | Since | Position with MidWestOne Financial | |||||||||||||||

2018(1) | Director of MidWestOne Financial and the Bank | ||||||||||||||||

| Charles N. Funk | 2000 | Director | |||||||||||||||

Director of MidWestOneFinancial | |||||||||||||||||

Director of MidWestOne Financial and the Bank | |||||||||||||||||

| Douglas K. True | 2017 | Director of MidWestOne Financial and the Bank | |||||||||||||||

| (1) | Mr. | ||||||||||||||||

| (2) | Ms. Hauschildt became a director of the Company and the Bank upon the resignation of Mr. Michael A. Hatch on January 1, 2019. She became a director of the Bank on January 15, 2019. | ||||||||||||||||

| Class III - Term Expiring 2022 | |||||||||||||||||

| Director | |||||||||||||||||

| Name of Individual | Since | Position with MidWestOne Financial | |||||||||||||||

| Janet E. Godwin | 2019 | Director of MidWestOne Financial and the Bank | |||||||||||||||

| Matthew J. Hayek | 2019 | Director of MidWestOne Financial and the Bank | |||||||||||||||

| Tracy S. McCormick | 2011 | Director of MidWestOne Financial and the Bank | |||||||||||||||

| Kevin W. Monson | 2005 | Chair of MidWestOne Financial and the Bank | |||||||||||||||

Larry D. Albert. Mr. Albert, 70, is the retired Executive Vice President of the Company, a position he held from the May 2015 completion of our merger with Central to his retirement in September 2015. He also served as Chief Executive Officer and as a director of Central Bank from 1996 to 2015. Mr. Albert currently serves as director of the Company and the Bank. He received his Bachelor’s degree from Westmar University and his MBA from the University of St. Thomas. Among other attributes, skills and qualifications, we believe Mr. Albert is qualified to serve as a director of the Company and on the Audit Committee because, as a Director of the Bank and former Chief Executive Officer of Central Bank, he is familiar with the Bank’s business and industry and with Bank strategy.

Charles N. Funk. Mr. Funk, 63,66, is the President and Chief Executive Officer of the Company since March 2008 and the Bank.Bank since November 2000. He joined our organization and served as President of the Company and the Bank in these same roles infrom November 2000.2000 to July 2020. Prior to that, he held positions as President and Central Region Manager and Chief Investment Officer for Brenton Bank-Des Moines. Mr. Funk has taught for the Colorado Graduate School of Banking in Boulder, Colorado, the Iowa School of Banking, and the Stonier Graduate School of Banking at Georgetown University. He haspreviously served on the board of Folience and the American Bankers Association and was the Chairman of the Iowa Bankers Association in 2010 and 2011. Mr. Funk graduated with a Bachelor’s degree from William Jewell College. We consider Mr. Funk to be a qualified candidate for service on the board due to his extensive expertise in the financial services industry, particularly in the state of Iowa, and intimate knowledge of MidWestOne Financial’sMidWestOne Financial Group’s business and operations and because of his role as the President and Chief Executive Officer of MidWestOneMidWestOne Financial and the Bank.

8

Douglas H. Greeff. . Mr. Hatch, 69, has been employedGreeff, 65, is the President of Greeff Advisory LLC in New York, New York, a shareholder advising service. He recently served as the Director and Executive Vice President of Omnisure LLC, a trialspecialty finance company and litigation attorney with Blackwell Burke P.A. since 2007.customized payment plan provider for vehicle and home service contracts, and Interim Chief Financial Officer of Microfinancial Inc., a specialized commercial/consumer finance company. He becamealso served as the Chief Financial Officer of Heyman Companies, and of Revlon, Inc., both of New York, New York. Mr. Greeff received his Bachelor’s degree in Economics from Williams College, and completed a directorMaster’s program in Accounting at the NYU School of Business Administration. We consider Mr. Greeff to be a qualified candidate for service on the board and the Compensation Committee due to his extensive finance and corporate experience.

Jennifer L. Hauschildt. Ms. Hauschildt, 51, is the Vice President of Human Resources for Uponor, a leading provider of crosslinked polyethylene (PEX) plumbing, radiant heating/cooling, hydronic piping, pre-insulated piping and fire sprinkler systems for residential and commercial structures worldwide, located in Apple Valley, Minnesota. She is a board member of the Company upon the completion of our merger with Central in May 2015. Among his prior experience, Mr. Hatch served as Minnesota’s Attorney GeneralMinnesota High Tech Association Foundation. Ms. Hauschildt received her Bachelor's degree from 1999 to 2007,Gustavus Adolphus College, and he has served on the boards of a number of insurance companies. He earned his Bachelor’s degreean MBA from the University of Minnesota-DuluthMinnesota. We consider Ms. Hauschildt to be a qualified candidate for service on the board and the Compensation Committee due to her extensive corporate experience, specifically relating to Human Resources and Information Technology.

Douglas K. True. Mr. True, 71, is the retired Senior Vice President for Finance and Operations and University Treasurer for the University of Iowa, positions he held from 1991 to 2016. Mr. True served as the Chief Financial Officer of the University of Iowa and provided operational oversight and management direction for a broad range of non-academic units including human resources, facilities management and utilities. He also oversaw the operating and capital budgets of the University of Iowa with broad responsibility for financial management and controls of all university budgets. Mr. True received an MBA from Drake University. We consider Mr. True to be a qualified candidate for service on the board, Audit Committee and Compensation Committee due to his Juris Doctorateextensive business and financial accounting expertise, as well as his knowledge of and prominence in our market area.

Janet E. Godwin. Ms. Godwin, 55, is the Chief Executive Officer of ACT, Inc, a nonprofit company and national leader in providing educational and career assessments, where she oversees content development, research, assessment delivery, program management, audit, risk and security services. Ms. Godwin received a Bachelor’s degree in English from the University of Minnesota Law School.Oklahoma, a Master’s degree in English from the University of Iowa, and has participated in the Advanced Management Program of the Wharton School at the University of Pennsylvania. She is a member of the Board of Education of the Iowa City Community School District and a board member of the Kirkwood Community College Foundation. Among other attributes, skills and qualifications, we believe that Mr. Hatch’sconsider Ms. Godwin to be a qualified candidate for service as aon the board member of insurance companies and extensive experiencethe Compensation Committee due to her business expertise and her strong ties within and significant involvement in the Minnesota legal arena enable himIowa City community.

Matthew J. Hayek. Mr. Hayek, 51, is an attorney at Hayek, Moreland, Smith & Bergus, LLP, a general service law firm in Iowa City, where his practice focuses on business and real estate law. A fifth generation Iowa Citian, Mr. Hayek received a B.A. with honors in Social Sciences from the University of Michigan and a J.D. from the University of Michigan Law School.Prior to bring valuable insightgraduate school, he served for two years in Bolivia with the United States Peace Corps. He worked at law firms in Atlanta and knowledgeChicago before returning to Iowa City. He served on the Company’sCity Council from 2008 to 2016 and as Mayor of Iowa City from 2010 to 2016. He has held leadership positions in various civic and nonprofit organizations and received the Iowa State Bar Association Pro Bono Award. He currently serves on the board of directors of Oaknoll Retirement Residence. Among other attributes, skills and qualifications, we consider Mr. Hayek to be a qualified candidate for service on the board and Compensation Committee.Nominating and Corporate Governance Committee due to his legal expertise and his significant involvement in the Iowa City community.

Tracy S. McCormick. Ms. McCormick, 57,60, is the Chief Financial Officer and a director of Mill Creek Development Company, an urban planning and development company in Pasadena, California. She currently serves on the board of Folience, a private company based in Cedar Rapids, Iowa. Her prior experience includes a career in investment banking with J.P. Morgan & Co., Incorporated in New York, Chicago, and Los Angeles. Ms. McCormick is the daughter of our former Chairman and current Director Emeritus, W. Richard Summerwill, and became a director of the Company in 2011 following his retirement from the board. She became a director of the Bank upon the completion of our merger with Central in May 2015. Ms. McCormick received a Bachelor’s degree in Economics and Communications from the University of Michigan and a M.Sc. in Economics from the London School of Economics and Political Science. We consider Ms. McCormick to be a qualified candidate for service on the board, the Audit Committee and the Compensation Committee due to her skills and expertise developed in investment banking and subsequent business experience.

9

Kevin W. Monson. Mr. Monson, 66,69, is the ChairmanChair of the Board of the Company and ChairmanChair of the Board of the Bank. He served as the President, Managing Partner and the largest shareholder of Neumann Monson, Inc., an architectural services firm headquartered in Iowa City, from 1992 through 2017, and is currently the Chairman of the Board and a shareholder of Neumann Monson, Inc. He became a director of the Company and the Bank in 2005. Mr. Monson is also the majority partner in Tower Partners, a real estate investment partnership, and several other real estate investment corporations. We consider Mr. Monson to be a qualified candidate for service on the board and Nominating and Corporate Governance Committee due to his skills and expertise developed as the head of a successful architectural firm and his knowledge of and prominence in the Iowa City market.

In addition, Mr. W. Richard Summerwill, who had served on our board of directors since our formation in 1983 and served as our long-time Chief Executive Officer prior to our merger with the former MidWestOne Financial in March 2008, and Mr. John S. Koza, who also had served on our board of directors since our formation in 1983 and retired from the board in 2014, both currently serve as non-voting Directors Emeriti.

EXECUTIVE OFFICERS

In addition to Charles N. Funk, who serves as our Chief Executive Officer as described above, the following individuals serve as executive officers of MidWestOne Financial, four of whomand are named in the compensation tables included in this proxy statement:

Len D. Devaisher. Mr. Devaisher, 44, is the President and Chief Operating Officer of the Company and the Bank. Prior to joining the Company in July 2020, he served as the Vice President for Resource Development for the United Way of Dane County.Prior to that, Mr. Devaisher was employed by Old National Bank, serving in a variety of roles between 2001 and 2019.Most recently, he served as Chief Executive Officer, Wisconsin Region, from 2016 to 2019.He also served as Chief Operating Officer of Young Life, Africa from 2010 to 2013.Mr. Devaisher earned a Bachelor of Science degree in Economics from the University of Evansville, completed the American Bankers Association Stonier Graduate School of Banking, and earned a leadership certificate in banking from The Wharton School at the University of Pennsylvania.

Barry S. Ray. Mr. Ray, 49, is the Senior Executive Vice President and Chief Financial Officer of the Company and the Bank. Prior to joining the Company in June 2018, he served in various accounting and finance roles at Columbia State Bank, a subsidiary of Columbia Banking System, Inc., since 2006, most recently as Chief Accounting Officer and Controller. Prior to that, he was employed as a Business Analyst, Investment Operations, with Russell Investment Group from 2005 to 2006, and prior to that, was a Consulting Services Manager with RSM US LLP from 2000 to 2005. Mr. Ray served in the U.S. Navy, and received his Bachelor’s degree from the University of Washington. He is a Certified Public Accountant.

James M. Cantrell. Mr. Cantrell, 58,61, is Senior Executive Vice President, Chief Investment Officer and Treasurer of the Company and Senior Vice President, Chief Investment Officer and Treasurer of the Bank. He has also served as the Interim Chief Financial Officer of both the Company and the Bank sincebetween December 2017.2017 and June 2018. He joined the Company in his current positions, other than InterimJuly 2009 as Senior Vice President and Chief Financial Officer, in July 2009.Risk Officer. Prior to joining the Bank, he had been with Provident Bank in Baltimore, Maryland, since 2008, where he served as Senior Vice President and Director of Treasury Operations. In that capacity, he was responsible for management of asset/liability activities, investment portfolio accounting, and derivative activity and compliance. Prior to that, he was employed as the Senior Vice President and Treasurer of Mercantile-Safe Deposit and Trust Company in Baltimore, Maryland, where he had been employed since 2001. Mr. Cantrell has a Bachelor’s degree in business and economics from Wittenberg University.

David E. Lindstrom. Mr. Lindstrom, 54, is the Executive Vice President-CommercialPresident, Retail Banking of the Bank, a position he has held since 2004. He has beenJanuary 2018. Prior to his employment with the Company andBank, Mr. Lindstrom was employed by BMO Harris Bank, a subsidiary of the Bank of Montreal, since 1986.

10

Table of the Agreement and Plan of Merger dated November 20, 2014, by and between Central and the Company (the “Merger Agreement”), as the holder of all of the outstanding shares of the common stock of Central, the John M. Morrison Revocable Trust #4 (the “Trust”) received as merger consideration, upon the closing of the merger on May 1, 2015, $64,000,000 in cash and 2,723,083 shares of MidWestOne Financial common stock, which represented 24.5% of the outstanding shares of MidWestOne Financial common stock at that tme. Mr. Morrison, a director of the Company, is the trustee of the Trust. As described under “SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT,” Mr. Morrison beneficially owned 431,393 shares as of February 13, 2018, or 3.5% of our common stock as of such date, which included 245,693 shares, or 2.0% of our common stock, beneficially owned by the Trust as of such date.Contents

CORPORATE GOVERNANCE AND BOARD MATTERS

General

The board has adopted guidelines on significant corporate governance matters that, together with our Code of Business Conduct and Ethics and other policies, creates our corporate governance standards. Generally, the board oversees our business and monitors the performance of our management. In accordance with our corporate governance standards, the board does not involve itself in the day-to-day operations of MidWestOne Financial, which is monitored by our executive officers and management. Our directors fulfill their duties and responsibilities by attending regular meetings of the board, which convene at least on a quarterly basis, and through committee membership, which is discussed below. Our directors also discuss business and other matters with Mr. Funk, our President and Chief Executive Officer, other key executives and our principal external advisers (legal counsel, auditors and other consultants).

With the exception of Messrs.Mr. Funk, Morrison, and Weise, each of our current directors and nominees is “independent,” as defined under The Nasdaq Stock Market LLC’s listing rules, and the board has determined that the independent directors do not have other relationships with us that prevent them from making objective, independent decisions. The board of directors has established an Audit Committee, a Nominating and Corporate Governance Committee and a Compensation Committee, each of which is currently made up solely of independent directors. The current charters of each of these committees are available on our website at www.midwestonefinancial.com. Our Code of Business Conduct and Ethics is also available on our website. Also posted on our website is a general description regarding our companyCompany and links to our filings with the SEC.

Our board of directors held teneight regular and special meetings during 2017.2020. All of the directors attended at least 75% of the board meetings and meetings of committees of which they were members. While we do not have a specific policy regarding attendance at the annual shareholdershareholders’ meeting, all directors are encouraged and expected to attend the meeting. Last year’s annual meeting of shareholders was attended in person or by telephone by all of the directors in office at such time, except for Mr. West.time.

Audit Committee

In 2017,2020, prior to the annual meeting of shareholders, the Audit Committee was comprised of Messrs. Donohue (Chairman)(Chair), Albert, Greeff, Kaeding, and Schwab,True, and Mses. McCormick and Stanoch.Ms. McCormick. Following the 20172020 annual meeting of shareholders, the Audit Committee haswas comprised of Messrs. Donohue (Chairman)(Chair), Schwab,Albert, and True, and Ms. McCormick. It is anticipated that the composition of the Audit Committee will remain the same throughout 2021. Each individual is considered to be “independent” under Nasdaq listing rules and the regulations of the SEC. It is anticipated that the compositionSEC, including Rule 10A-3 of the Audit Committee will remain the same throughout 2018, except that Mr. Kaeding is expected to join the Audit Committee following the 2018 annual meeting of shareholders.Exchange Act. The board of directors has determined that Mr. Donohue qualifies as an “audit committee financial expert” under the regulations of the SEC. The board has based this determination on Mr. Donohue’s education and his professional experience as the former managing partner of a certified public accounting firm.

The functions performed by the Audit Committee include, among other things, the following:

•overseeing our accounting and financial reporting;

•selecting, appointing and overseeing our independent registered public accounting firm;

•reviewing actions byand discussing with management on recommendations ofand the independent registered public accounting firmauditor the annual audited and internal auditors;quarterly unaudited financial statements, including disclosures made in management’s discussion and analysis, earnings press releases and any earnings guidance provided to analysts and rating agencies, prior to the release of quarterly and annual earnings results;

•meeting with management, the internal auditors and the independent registered public accounting firm to review the effectiveness of our system of internal controls and internal audit procedures; and

To promote independence of the audit function, the Audit Committee consults separately and jointly with our independent registered public accounting firm, the internal auditors and management. We have adopted a written charter for the committee,Audit Committee, which sets forth its duties and responsibilities. The current charter is available on our website at www.midwestonefinancial.com.www.midwestonefinancial.com under “Corporate Information - Committee Charting” and by clicking on “Audit Committee.” In 2017,2020, the committeeAudit Committee met fifteenfourteen times.

11

Compensation Committee

In 2017,2020, prior to the annual meeting of shareholders, the Compensation Committee of MidWestOne Financial was comprised of Messrs. West (Chairman), Hatch, and Ruud, and Ms. McCormick. Following the 2017 annual meeting of shareholders, the Compensation Committee of MidWestOne Financial has comprised of Ms. McCormick (Chairperson)(Chair), Ms. Godwin, Ms. Hauschildt, and Ms. Stanoch, and Messrs. Hatch, True,Hartig and West.True. Mr. WestGreeff replaced Mr. Hartig on the Compensation Committee following the 2020 annual meeting of shareholders. It is anticipated that the composition of the Compensation Committee will leaveremain the committee upon his retirement from the board of directors in April 2018.same throughout 2021. Each individual served asis considered to be an “independent” director as defined by Nasdaq listing requirements,rules, an “outside” director pursuant to Section 162(m) of the Internal Revenue Code and a “non-employee” director under Section 16 of the Exchange Act.

The Compensation Committee is responsible for the development of MidWestOne Financial’s compensation philosophy and the design, implementation and monitoring of its executive compensation programs. It determines the structure and components of the programs and reviews and approves the compensation of our named executive officers (“NEOs”). The Compensation Committee annually assesses the performance of our Chief Executive Officer, Charles N. Funk, and determines thehis salary, short-term incentive compensation and bonus paid to him.long-term incentive compensation. It also reviews and determines the salaries and bonuses paid toincentive compensation of our other Named Executive Officers (“NEOs”). The Compensation Committee reliesNEOs, based upon Mr. Funk’s assessment of each NEO’s individual performance, which considers, as applicable, each executive’s efforts in achieving his or her individual goals each year and the executive’s overall success in the performance of his or her role in the organization. Individual goals for NEOs are established by Mr. Funk in consultation with each executive officer which consider the strategic and financial objectives of the Company.performance. The Compensation Committee also consults with management and its independent advisors on a variety of matters, including the annual review of MidWestOne Financial’s compensation programs relative to overallits peers and industry best practices. It ensures that its programs do not create inappropriate risk to MidWestOne Financial and uses its best judgment to develop executive compensation programs that are consistent with the Company’s operating principles, strategy and respective performance of our NEOs. No executive officer participates in any recommendation, discussion, or decision with respect to his or her own compensation or benefits. Further, the Compensation Committee administers our overall executive compensation program including equity incentive plans, our long-term incentive plans and our executive incentive bonus plans. As a result, it has ultimate responsibility for interpretation and oversight of those plans.

performance. The Compensation Committee’s duties, responsibilities, and functions are further described in its charter. The committeeCommittee reviews its charter at least annually. It then recommends approval of the charter to the Company’s boardMidWestOne Financial’s Board of directors.Directors. The committee’sCommittee’s charter is available on our website, www.midwestonefinancial.com.www.midwestonefinancial.com under “Corporate Information – Committee Charting” and by clicking on “Compensation Committee.”

The charter gives the Compensation Committee the authority to hire outside consultants and independent advisors to further its objectives and responsibilities. For the last several years, and again in 2017, the Compensation Committee has retained the independent compensation consultant services of F.W. Cook & Co. (“F.W. Cook”), Chicago, Illinois, to provide expertise and serve as a resource with respect to current market activities involving executive compensationmarketplace and best practices relating to competitive pay levels for executives and procedures,board members and also to help review and analyze our executive compensation practices and procedures. F.W. Cook & Co. provides no other services to the Company, and the Compensation Committee believes F.W. Cook & Co. is independent as determined under applicable Nasdaq guidance.

The Compensation Committee met foursix times during 2017, convening in January, February, August, and December.2020. Ms. McCormick also met as needed with internal staff members and members of management, as well as the Committee’s independent advisors, to prepare for committee meetings and to assemble compensation information for this proxy statement.

Nominating and Corporate Governance Committee

In 2017 the members of2020, the Nominating and Corporate Governance Committee of MidWestOne Financial werewas comprised of Messrs. Schwab (Chairman)Monson (Chair), Donohue, Hartig, Hayek, and Zaiser,Kaeding, and Ms. Stanoch, and these individuals currently comprise the Nominating and Corporate Governance Committee. Each individual is considered “independent” under Nasdaq listing rules.Stanoch. It is anticipated that the composition of the Nominating and Corporate Governance Committee will remain the same throughout 2018,2021, except that following the Annual Meeting, Mr. KaedingMonson will step off the committee and Mr. Hayek will be named Chair. Each individual is expected to joinconsidered “independent” under Nasdaq listing rules. The primary purposes of the Nominating and Corporate Governance Committee following the 2018 annual meeting of shareholders. The primary purposes of the committee are to identify and recommend individuals to serve on our board of directors and to review and monitor our policies, procedures and structure as they relate to corporate governance. We have adopted a written charter for the committee,Nominating and Corporate Governance Committee, which sets forth its duties and responsibilities. The current charter is available on our website at www.midwestonefinancial.com.www.midwestonefinancial.com, under “Corporate Information - Committee Charting” and by clicking on Nominating & Corporate Governance Committee.” In 2017,2020, the committeeNominating and Corporate Governance Committee met fivefour times.

Director Nominations and Qualifications

For the 20182021 annual meeting, the Nominating and Corporate Governance Committee nominated for re-election to the board threefive incumbent directors whose current terms are set to expire at the 20182021 annual meeting and one new nominee.meeting. These nominations were further approved by the full board. We did not receive any properly-made shareholder nominations for directorships for the 20182021 annual meeting.

12

The Nominating and Corporate Governance Committee evaluates all potential nominees for election, including incumbent directors, board nominees and any shareholder nominees included in the proxy statement, in the same manner. Generally, the committee believesThe Nominating and Corporate Governance Committee reviews qualified candidates for directors and focuses on those who present varied, complementary backgrounds that at a minimum, directors should possess certain qualities, including the highest personalemphasize both business experience and professional ethics and integrity, a sufficient educational and professional background, demonstrated leadership skills, sound judgment, a strong

The committee also evaluates potential nomineesNominating and Corporate Governance Committee has established the following minimum criteria, which it considers necessary for service on the board:

•Each nominee shall meet the minimum requirements for service on the board of directors contained in the Company's bylaws and articles of incorporation;

•Each nominee shall possess the highest personal and professional ethics, integrity and values;

•Each nominee shall have, in the Nominating and Corporate Governance Committee's opinion, a sufficient educational and professional background and have relevant past and current employment affiliations, board affiliations and experience for service on the board;

•Each nominee shall have demonstrated effective leadership and sound judgment in his or her professional life;

•Each nominee shall have a strong appreciation for the community-minded focus of the Company;

•Each nominee shall have exemplary management and communications skills. Most importantly, each nominee must possess the requisite skills and desire to determine if they have anywork well within the board structure;

•Each nominee shall be free of conflicts of interest that maywould prevent him or her from serving on the board;

•Each nominee shall be expected to ensure that other existing and future commitments do not materially interfere with their abilityhis or her service as a director of the Company;

•Each nominee shall review and agree to meet the standards and duties set forth in the Company's Code of Business Conduct and Ethics;

•Each nominee shall be willing to devote sufficient time to carrying out his or her duties and responsibilities effectively, and should be committed to serve as effectiveon the board membersfor an extended period of time; and to determine whether they are “independent” in accordance with Nasdaq listing rules (to ensure

•The "independence" of non-management nominees shall be taken into account so that at least a majority of the board of directors will at all times, be independent). The committee has not, inmade up of directors who satisfy the past, retained any third party to assist it in identifying qualified candidates.independence standards set forth by Nasdaq.

The committee identifies nominees by first evaluating the current members of the board whose term is set to expire at the upcoming annual shareholder meeting and who are willing to continue in service. Current members of the board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination. If any member of the board does not wish to continue in service or if the committee or the board decides not to re-nominate a member for re-election, the committee would identify the desired skills and experience of a new nominee in light of the criteria above. Mr. Kaeding, the nominee for election at the 2018 annual meeting of shareholders, was nominated to the board of directors by Mr. Schwab.

Board Leadership Structure

The positions of ChairmanChair of the Board and Chief Executive Officer of MidWestOne are currently held by separate individuals. We believe this is the most appropriate structure for our board at this time. The ChairmanChair provides leadership to the board and works with the board to define its structure and activities in the fulfillment of its responsibilities. The ChairmanChair sets the board agendas with board and management input, facilitates communication among directors, works with the Chief Executive Officer to provide an appropriate information flow between management and the board and presides at meetings of the board and shareholders. With the Chairman’sChair’s assumption of these duties, the Chief Executive Officer may place a greater focus on our strategic and operational activities. We also believe our board feels a greater sense of involvement and brings a wider source of perspective as a result of this structure, from which we benefit.

13

Independent Director Sessions

The board of directors has created the position of a “lead” independent director, currently filled by Ms. McCormick. The Nominating and Corporate Governance Committee reviews this appointment annually, and the full board has the opportunity to ratify the committee’s selection. It is expected that Ms. McCormick will continue to serve as lead independent director after the 20182021 annual meeting of shareholders. The lead independent director assists the board in assuring effective corporate governance and serves as chairmanchair of the independent director sessions. Consistent with Nasdaq listing rules, the independent directors regularly have the opportunity to meet without the non-independent directors present, and in 20172020 there were two such sessions.

Board’s Role in Risk Oversight

Risk is inherent within every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including general economic risks, credit risks, regulatory risks, audit risks, reputational risks, cyber risks and others, such as risks related to the unintentional effects our compensation plans may have on employee decision-making or the impact of competition. Management is responsible for the day-to-day managementcontrol of risks the Company faces, while the board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the board of directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

While the full board of directors is charged with ultimate oversight responsibility for risk management, various committees of the board and members of management also have responsibilities with respect to our risk oversight. In particular, the Audit Committee plays a large role in monitoring and assessing our financial, legal, and organizational risks, and receives regular reports from our Chief Risk Officersenior officers regarding comprehensive organizational risk as well as particular areas of concern. The Company’s Enterprise Risk Management Committee also plays an important role in risk management, with oversight of the Company’s overall risk framework, risk appetite, and the identification, measurement, and monitoring of key risks. The Company’s Compensation Committee monitors and assesses the various risks associated with compensation policies and oversees incentive plans to ensure a reasonable and manageable level of risk-taking consistent with our overall strategy. Additionally, our Chief Credit Officer and loan review staff are directly responsible for overseeing our credit risk.

We believe that establishing the right “tone at the top” and providing for full and open communication between management and our board of directors are essential for effective risk management and oversight. Our executive management meets regularly with our other senior officers to discuss strategy and risks facing the Company. Senior officers attend many of the board meetings or, if not in attendance, are available to address any questions or concerns raised by the board on risk management-related and

any other matters. Additionally, each of our board-level committees provides regular reports to the full board and apprises the board of our comprehensive risk profile and any areas of concern.

Code of Ethics

We have a Code of Business Conduct and Ethics in place that applies to all of our directors, officers and employees. The code sets forth the standard of ethics that we expect all of our directors, officers and employees to follow, including our Chief Executive Officer and Chief Financial Officer. The Code of Business Conduct and Ethics is posted on our website at www.midwestonefinancial.com.www.midwestonefinancial.com, under “Corporate Information - Governance Documents.” We intend to satisfy the disclosure requirements under Item 5.05(c) of Form 8-K regarding any amendment to or waiver of the code with respect to our Chief Executive Officer and Chief Financial Officer, and persons performing similar functions, by posting such information on our website.

Anti-Hedging Policy

Our insider trading policy prohibits our directors, officers and employees from entering into any hedging transaction with respect to any of the Company’s securities. This prohibition includes the direct or indirect purchase or use of stock options, prepaid variable forward contracts, equity swaps, collars, exchange funds or any other instruments designed to offset any decrease in the market value of the Company’s securities.

14

AUDIT COMMITTEE REPORT

The Audit Committee is comprised of four members of the board of the Company. All the members of the Audit Committee are independent from management and the Company, as independence is currently defined in the Nasdaq listing requirements.rules and Rule 10A-3 of the Exchange Act. The Audit Committee is governed by a charter. A copy of the charter is available on the Company’s website.website at www.midwestonefinancial.com.

The Company’s management has the primary responsibility for the financial statements, for maintaining effective internal control over financial reporting and for assessing the effectiveness of internal control over financial reporting. The Audit Committee discussed with management and the Company’s independent registered accounting firm, which we referreferred to in this report as the external auditor, the Company’s annual and quarterly SEC reports on Forms 10-K and 10-Q including the Company’s financial statements and disclosures prior to their public release. The Audit Committee also reviewed, where appropriate, other selected SEC filings and public disclosures regarding financial matters, such as earnings releases, prior to their public release. The Audit Committee discussed with Company management and the external auditor the changes in accounting rules or standards that could materially impact the Company’s financial statements and the implementation of those rules or standards.

The meetings of the Audit Committee are designed to facilitate and encourage communication among the Audit Committee, the Company, the Company’s internal auditors and the Company’s external auditor. The Audit Committee discussed with the Company’s internal auditors and external auditor the overall scope for their respective audits. The Audit Committee meets with the internal auditors and external auditor, with and without management present, to discuss results of their examinations, their evaluations of the Company’s internal control, and overall quality of the Company’s financial reporting. All audit and non-audit services performed by the external auditor of the Company require approval of the Audit Committee.

As part of its oversight responsibility, the Audit Committee periodically reviewsengages in an annual evaluation of the external auditor’s qualifications, performance and independence, and considers whether continued retention of the Company’s independent registered public accounting firm is in connection with the determination to retainbest interest of the external auditor. In conductingCompany. The Audit Committee is also involved in the review for its 2018 recommendation to retainselection of the lead engagement partner. While RSM US LLP has been retained as the external auditor,Company’s independent registered public accounting firm since 2013, in accordance with SEC rules and RSM US LLP’s policies, the firm’s lead engagement partner rotates every five years. In assessing RSM US LLP’s qualifications, performance and independence in 2020, the Audit Committee considered, factorsamong other things:

•the length of time RSM US LLP has been engaged;

•RSM US LLP’s independence and objectivity;

•RSM US LLP’s industry specific experience;

•historical and recent performance, including the professional qualificationsextent and quality of RSM US LLP’s communications with the Audit Committee, and feedback from management regarding RSM US LLP’s overall performance;

•external auditor, the external auditor’sdata on audit quality and performance, including recent and historical performance related to the Company’s audit, including a review of auditor performance feedback surveys completed by management, results of Public Company Accounting Oversight Board (PCAOB) examinations,(“PCAOB”) inspection reports on the firm; and an evaluation

•the appropriateness of RSM US LLP’s fees, including those related to non-audit services.

The Audit Committee believes that the external auditor’s independence.continued retention of RSM US LLP has beenas our independent registered public accounting firm is in the external auditor forbest interests of the Company since 2013.and our shareholders.

The Audit Committee has reviewed and discussed our audited financial statements for the year ended December 31, 20172020 with our management and RSM US LLP, the independent registered public accounting firm that audited our financial statements for that period. The committeeAudit Committee has also discussed with RSM US LLP the matters required to be discussed by Auditing Standards No. 1301,the applicable requirements of the PCAOB and the SEC, and has received and discussed the written disclosures and the letter from RSM US LLP required by the applicable requirements of the PCAOB Rule 3526, Communicationregarding RSM US LLP’s communications with the Audit Committees Concerning Independence.Committee concerning independence and has discussed with RSM US LLP its independence. Based on the review and discussions with management and RSM US LLP, the Audit Committee has recommended to the board that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 20172020 for filing with the SEC.

Submitted by:

The MidWestOne Financial Group, Inc. Audit Committee

15

Richard R. Donohue (Chairman)(Chair)

Larry D. Albert

Tracy S. McCormick

Douglas K. True

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion & Analysis (“CD&A”) section describes MidWestOne Financial Group’s compensation philosophy and policies as applicable to the NEOs listed in the Summary Compensation Table on page 24.26. It explains the structure of each material element of compensation and provides context for the more detailed disclosure tables and specific compensation amounts provided followingwhich follow this CD&A.

MidWestOne Financial Group and MidWestOne Bank share an executive management team. The members of the executive management team, including the NEOs, are compensated by the Bank, not by MidWestOne Financial. The terms of our executives’ total compensation packages of the NEOs are determined and approved by the Compensation Committee (the “Committee”) based on the executives’each executive’s individual performance and roles for both MidWestOne Financial and MidWestOne Bank.

Named Executive Officers

In this CD&A and the executive compensation tables that follow, we are reportingour six “namednamed executive officers” or “NEOs.” Our formerofficers (“NEOs”) in 2020 were:

•Charles N. Funk, Chief Executive Officer

•Len D. Devaisher, President and Chief Operating Officer